Best State to Raise a Family in the Us

While beach-filled states similar Florida immediately come up to listen when one thinks of retirement, there are plenty of other factors to consider outside of warm weather and proximity to golf courses. For example, while states similar California and New York have laws that can make information technology catchy to alive on a fixed income, states without income tax — or with exemptions for senior Americans — make the day-to-day much less stressful. To help yous out, we've rounded up the best of the all-time states for retirees, from ocean to shining bounding main.

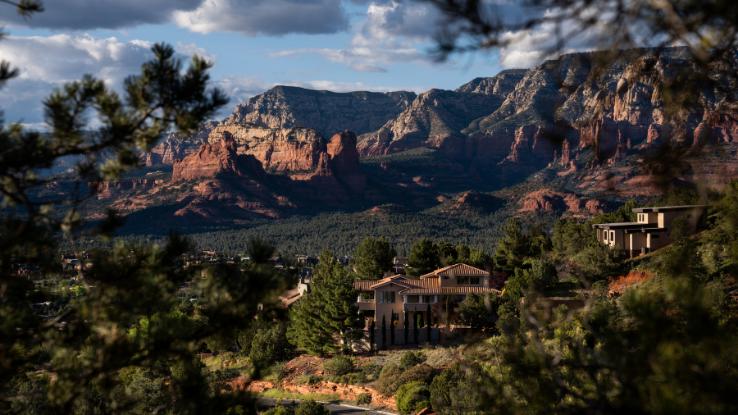

Arizona

If you've spent your entire life enduring freezing common cold winters, Arizona tin be a welcome respite. While there are a few places in the state that receive a off-white amount of snow, such as Flagstaff and Williams, much of the state averages only a couple inches per year — or none at all. Of course, yous'll still desire to invest in air conditioning: Temperatures in summertime often range betwixt 90 and 120 degrees Fahrenheit. In fact, the most difficult decision might simply exist picking where in the state y'all desire to live.

There's the land'south very get-go planned retirement community, Dominicus City, which is located but outside Phoenix, and some other popular choice, Scottsdale, which has one of the highest percentages of people over 65 in the state. For retirees who want to savour the keen outdoors, the state'due south desert climate allows for yr-circular golfing and enough of opportunities to explore national parks and monuments, including the Grand Coulee and the Red Rocks near Sedona. Unfortunately for folks on a fixed income, Arizona does collect income tax, but at 2.59 to iv.50%, the rate is notwithstanding adequately depression compared to much of the country — and the same goes for property taxes. Sales tax, however, is a whole different brawl game and ranges between five.60 and 11.20%, making Arizona the 11th highest state for sales tax.

Sure, Florida might seem like the most obvious choice, but it continually makes our listing for two major reasons. First, the state boasts incredible beaches and cute weather year-round — perfect for those who like to sunbathe, sip mojitos and swim. The 2nd major cistron that makes Florida so desirable is that the state has no income or estate taxes, making it a prime destination for folks over 65 who are living on a fixed income. Plus, of the top 10 cities in the U.Due south. with the largest percentages of folks over 65, eight of them are in the Sunshine State, so yous'll exist in good company.

Of form, like every state on our list, there are some drawbacks to retiring in Florida. The weather is mostly gorgeous, but short-yet-frequent thunderstorms and flood-causing hurricanes are fairly mutual events, which, in add-on to being stressful, can likewise increase your insurance rates. Another deterrent? The wild animals, which ranges from the state's native alligators to invasive species like boa constrictors and golf course-loving capybaras. Nevertheless, the state'south iconic Florida Keys, e'er-bustling Miami and Orlando metropolitan areas, and myriad golf courses — when combined with all those senior benefits — continue to get in a popular destination for retirees.

Colorado

If you're looking to retire to an alpine wonderland, Colorado is ideal. For those who honey living close to nature, Colorado'south proximity to incredible mountain ranges and national parks tin can't be beat. The country also ranks highly in life expectancy thank you to its quality preventative care and healthy living surroundings. The only drawback? Colorado'south cost of living isn't as heavenly as the natural splendor.

While smaller towns are less expensive than big-proper noun ones like Boulder, it'due south definitely non the easiest on the wallet of all the options on our listing. Interestingly, Colorado'southward tax benefits are adequately unique: Instead of taxing retirement income in the way earned income would be taxed, Colorado uses a "alimony/annuity subtraction" model, which means that qualifying pensions and annuities are excluded up to $20,000 for adults ages 55 to 64 and $24,000 for anyone 65 or older. On top of that, there's besides a 50% homestead exemption on chief residences, so long as you've lived in Colorado for 10 years or more. Needless to say, there's no better time than the present to look into retirement in the Centennial State.

South Carolina

While S Carolina may exist all-time known for its vacation-friendly beaches, golf game courses and historic sites, information technology's also a hotspot for retirees, partially because folks visit and fall in dear with the country. According to South Carolina's official tourism website, roughly 110,000 people made the Palmetto State their permanent residence in 2017 and, of those new residents, approximately 2-thirds were over the age of 50. Without a doubt, one of the state'southward biggest draws is the climate. Certain, Due south Carolina's sunny weather means endless golfing opportunities, just it also means boating, hiking, tennis and other outdoor activities on a well-nigh year-circular ground.

Additionally, quality of life and healthcare have also received acme marks, with retirees citing the state's relative affordability due in large part to the fact that S Carolina doesn't tax Social Security benefits — and because the land provides a generous retirement-income deduction when calculating country income tax. In addition to coastal favorites like Myrtle Beach, Charleston, Mt. Pleasant and Hilton Head Isle, South Carolina also boasts not bad retiree communities throughout the Midlands since the area benefits from being in close proximity to Columbia, the state capital. The flexibility of living near a college town or city means that folks tin enjoy their solace while as well benefiting from piece of cake access to the entertainment events and activities that crop up in these younger spots.

South Dakota

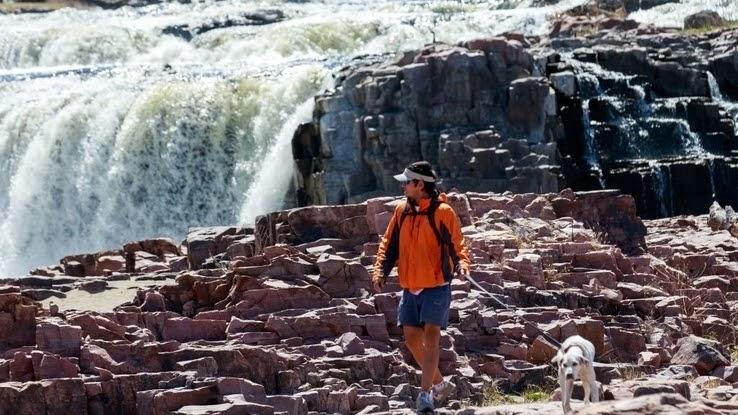

We can all agree that warm weather is great, simply it'due south by no means the only affair to look for when choosing a retirement spot. Although South Dakota lacks warm beaches, it does boast a

lack of income revenue enhancement, an affordable cost of living and a booming economy. Admittedly, the state's weather can get intense, with hot summers and cold winters — not to mention, the southeastern portion of South Dakota doubles as the upper end of Tornado Aisle due to the lack of mountains and trees in the area.

Still, it isn't all flat roads and remote farmland. South Dakota teems with beautiful scenery and national parks that are perfect for hunting and fishing enthusiasts too as runners, cyclists and hikers. And, thanks to the state's robust telehealth system, healthcare isn't an issue, even if you are living way out in that location. If you lot're more into small-boondocks living, we recommend Sioux Falls, which combines the best of the Dakotas' natural dazzler with the civilities of a more populous surface area.

Utah

Utah might not exist on many people'southward radar as a place to retire, but that should change. With deserts in the s and mountainous forests in the north, Utah has something for sun and snow lovers akin. Not to mention, the Beehive State actually boasts more than national parks than any other land exterior of Alaska and California. From Monument Valley to the Great Salt Lake, in that location'due south no shortage of natural splendor — or ski resorts — making Utah perfect for folks who want a more active lifestyle even in retirement.

Southern cities like Moab and St. George are all-time for retirees who are done with snowfall and its related perils, while Ogden and Logan make wonderful destinations for retirees eager to hitting the slopes. If you want a (somewhat) big-city experience with easy access to air travel and other civilities, look into Salt Lake Metropolis, the state's capital. With a five% country income taxation and fairly middle-of-the-road taxes outside of that, Utah is also more than affordable than some of the other outdoors-minded gems on our list. Even so, it'due south also ane of simply 14 states that taxes Social Security income, and the average toll of living is slightly higher than the national average, which means there are definitely some pros and cons to consider before moving to Utah.

Nevada

If finding a tax-friendly retirement spot is at the top of your "needs" list, then Nevada might just be the place for you lot. With no state taxes on income or Social Security benefits, information technology's kind of perfect for folks who are living on a stock-still income. As an added bonus for you and your wallet, withdrawals from retirement accounts and pension income also aren't taxed, which means your retirement lifestyle might look a scrap more comfortable — or, you know, Las Vegas' casinos might wait a tad more highly-seasoned.

While your finances might benefit from a move to Nevada, it's also important to note that the country doesn't rank particularly loftier in other categories. Sure, the revenue enhancement climate is favorable, simply the Silverish State'south actual climate isn't as appealing every bit other desert-laden states, like Arizona. Even more troubling is the state's rankings when information technology comes to quality of healthcare. Still, there'south something to exist said for the affordability and, depending upon where you settle, proximity to Vegas and holiday-worthy states like California and Arizona.

New Hampshire

Pic this: a retirement that includes a delightful mix of cool summer nights by a bonfire, crisp autumn days spent leaf-peeping and cozy winters spent sipping hot cocoa. You tin can have all that past retiring to New Hampshire, a small state with a lot to offer. In fact, its size is ane of its perks because, no matter where you settle downwards, you'll never be far from mountains, lakes and the state's biggest towns, similar Manchester, Keene and Concord. Fifty-fifty Boston, Massachusetts, isn't all that far from the Granite State.

Of course, it isn't all sunshine and rainbows in New Hampshire. In January, the temps can drop to x degrees Fahrenheit — or colder — and it stays pretty chilly through March. While snow tin exist nifty for winter sports, you'll have to contend with at least a few feet a year, so if you hate shoveling and slick roads New Hampshire might not be for y'all. On the other mitt, the state doesn't collect personal income taxes, and so you tin enjoy your Social Security benefits tax-gratis. Better nevertheless, New Hampshire doesn't levy a sales taxation, then while the property taxes and price of living might be a tad college than average, you'll save in other means.

Wyoming

Similar to South Dakota, Wyoming offers a mix of royal mountains and broad plains likewise as easy living. With famed national parks and monuments like Yard Teton and Yellowstone not far away, you'll be able to commence on some pretty memorable hikes if an active retirement sounds right up your aisle. Of course, if you're trying to get away from friends, family and everyone else, Wyoming tin can aid with that, likewise — after all, it's the least populous state in the entire country.

While the weather in Wyoming can be intense, the snow isn't as bad as you lot might expect on the plains. Nonetheless, if you can deal with the whiplash of hot summers and freezing winters, existence a Wyoming resident has some serious financial benefits. For example, Wyoming boasts an appealing combination of depression property taxes, peachy healthcare, cheap real estate prices and absolutely no state income revenue enhancement. So, if you're looking for a quieter retirement — with an affordable price of living — information technology may be worth weathering the Cowboy State.

Iowa

When it comes to listing out retirement options, Iowa probably isn't the outset state that comes to listen, but, surprisingly, it is a neat choice for folks who want to savour a comfortable quality of life and like shooting fish in a barrel access to recreational and cultural activities. In general, Iowa has a low cost of living, but, for retirees, there's also a $half-dozen,000 tax deduction available to those 55 and older. And while Iowa doesn't count Social Security every bit income, the land does collect personal income tax, which tin run every bit loftier as near nine%.

And so, what are the Hawkeye State's drawbacks? Fifty-fifty though Iowa receives a pocket-sized amount of snowfall, it nevertheless boasts icy winters and hot, boiling summers. Moreover, for folks accustomed to a more cosmopolitan environment, Iowa might feel a bit sleepy. Of course, there's nothing wrong with some peace and quiet, especially when the state offers plenty of recreational activities — hiking, fishing, golfing — likewise as volunteer opportunities, so long as y'all're willing to travel a flake.

Source: https://www.reference.com/geography/best-states-to-retire-to-in-the-us?utm_content=params%3Ao%3D740005%26ad%3DdirN%26qo%3DserpIndex

0 Response to "Best State to Raise a Family in the Us"

إرسال تعليق